The Enterprise Investment Scheme (EIS) is a great way for early stage businesses to attract potential investors and accelerate their growth. Unfortunately, it involves quite a bit of paperwork, served with a generous side of EIS terminology! But worry not - this guide to EIS was specifically designed to give you a good overview of what you need to know about the EIS scheme, without getting lost in all the mumbo-jumbo! Let’s take a look.

Note that this article does not provide legal, financial, accounting or tax advice, and Carta encourages you to consult a qualified professional advisor before making any decision or taking any action that may affect your business or interests. Carta is not affiliated with or endorsed by HMRC, and questions regarding use of the HMRC online portal should be directed to your professional advisors and/or HMRC.

What is EIS?

EIS stands for "Enterprise Investment Scheme" and is a tax relief plan established in 1992 by the UK government to encourage investments in early-stage businesses.

Essentially, EIS incentivizes investors to support EIS eligible businesses, by offering them potentially significant income tax (up to 30%) and capital gains reliefs (up to 50%) when they do so. That’s why, qualifying as an EIS business may very well increase your appeal to potential investors. In fact, in 2019 £2Bn pounds were invested in UK startups through EIS - which is unsurprising, considering that 80% of all UK angel investments are EIS/SEIS*.

* SEIS (Seed Enterprise Investment Scheme) is a scheme similar to EIS, designed for slightly smaller companies. More on SEIS at the end of this guide.

Do I qualify for EIS?

First thing’s first: in order to apply for an EIS scheme, you must meet a certain set of criteria laid out by HMRC. Specifically, you must:

-

Have a permanent place of business in the UK (office, factory, branch etc.).

-

Not be listed or intend to be listed on a recognized stock exchange at the time you’re issuing shares.

-

Employee less than 250 full-time staff members, or 500 if you qualify as a Knowledge Intensive Company (see further down).

-

Have gross assets worth under £15mill. before any shares issuances, and maximum £16mill. immediately afterwards.

-

Be involved in a qualifying trade (see further down).

-

Not control any other companies, with the exception of qualifying subsidiaries.

-

Be independent (i.e. not controlled by another company, or have more than 50% of your shares owned by another business).

-

Have made your first commercial sale less than 7 years ago (12 years for Knowledge Intensive Companies).

-

Not expect to close after the completion of a project or series of projects.

-

Intend to use your EIS funds to continue trade, start a new type of trade, or proceed with relevant research and development. You must not use EIS funds to acquire another business or trade.

-

Plan to utilize the received funds within two years from the time you issue the shares.

* Please note that this is not an exhaustive list of requirements. You’re advised to consult the full HMRC EIS guidelines before applying.

How much can I raise under EIS?

EIS allows you to raise up to £5 million per year, and a total of £12 million over your company’s lifetime. Note that this includes funds you may have raised through other venture capital schemes (including SEIS, social investment tax relief (SITR), and/or state aid offered under the risk finance guidelines); it also includes potential funds raised by any of your business’s current and/or former subsidiaries, as well as businesses you may have acquired.

What are the EIS rules for investors?

Just as HMRC has outlined a specific set of criteria about which businesses qualify for EIS, there are also several rules determining who can invest through the scheme. Here’s what’s important to know:

-

EIS investors must be UK taxpayers.

-

Each investor may invest a maximum of £1 million in EIS qualifying companies per tax year.

-

Investors cannot sell or gift their shares for at least three years after their purchase. Otherwise, their tax relief benefits reverted.

-

The shares bought by any investor must be new (i.e. not already on the market).

-

Investors are not allowed to carry-forward their EIS tax relief.

-

Investors cannot be employees, partners, or a paid Director in the EIS company they’re investing (unless they are appointed in a Director’s position after already having received their EIS shares).

-

No individual investor can be issued more than 30% of your business’s total share capital.

For the company: You must remember that your investors will only be entitled to their EIS tax benefits provided that you follow the scheme’s rules for a minimum of 3 years after receiving their investment. Should you not do so, your investors’ tax benefits may be withheld or withdrawn. That’s why, if you become ineligible for EIS during the initial 3 year period, you must make sure to inform HMRC within 60 of the change that rendered you ineligible.

How does the EIS process work?

As a general note, you should know that EIS is administered by HMRC’s Small Company Enterprise Centre (SCEC). SCEC are the ones to check your paperwork and ultimately decide whether you qualify for EIS or not.

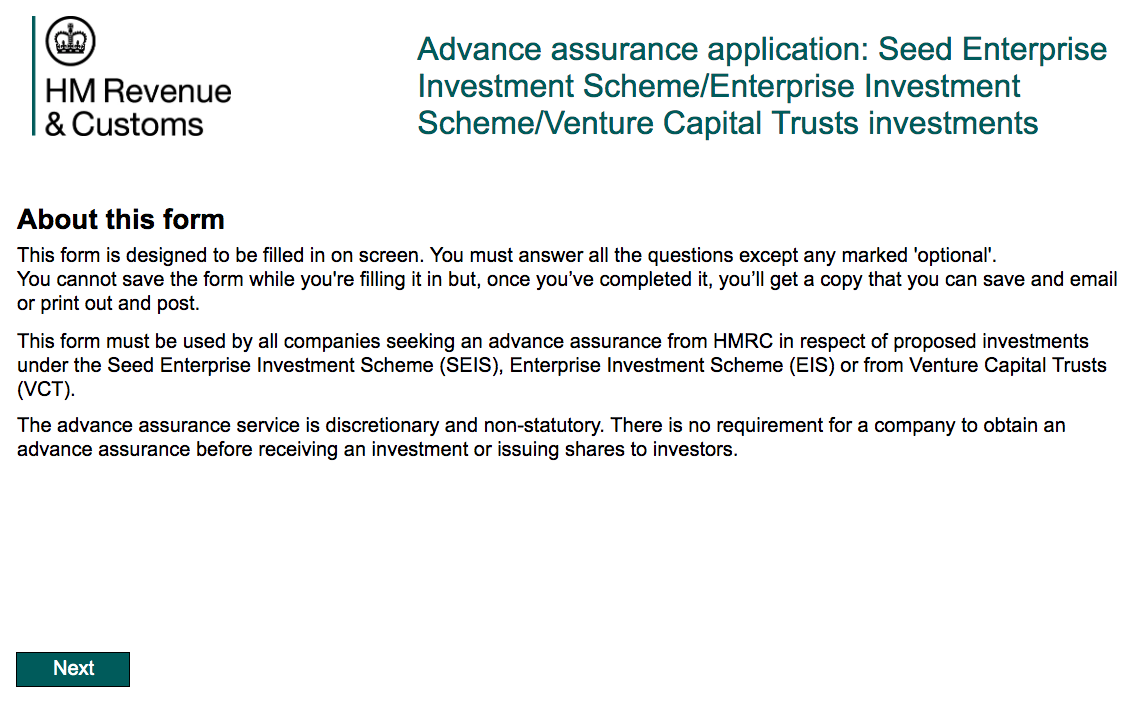

What is an Advance Assurance?

In terms of the process, most companies start by filing an Advance Assurance application to HMRC. This is an application which, provided it receives approval, grants the business a provisional indication from HMRC that you qualify for EIS, and therefore so will potential investments coming into your company. ‘Provisional’ is the key term here, as an approved advance assurance does not 100% guarantee that you qualify for EIS; it’s simply an indication that you are extremely likely to qualify, but nevertheless full EIS eligibility can only be confirmed after potential investments have been made.

Filing an Advance Assurance is not a compulsory requirement in order to qualify for the scheme. However, most small companies find that it is helpful when trying to convince potential investors to buy shares, so most commonly they will opt to file the application. The Advance Assurance form includes information regarding: how you plan to raise fund, your business structure, and your business activities. You will also need to file in a copy of the business plan you’ve presented to any potential individual investors.

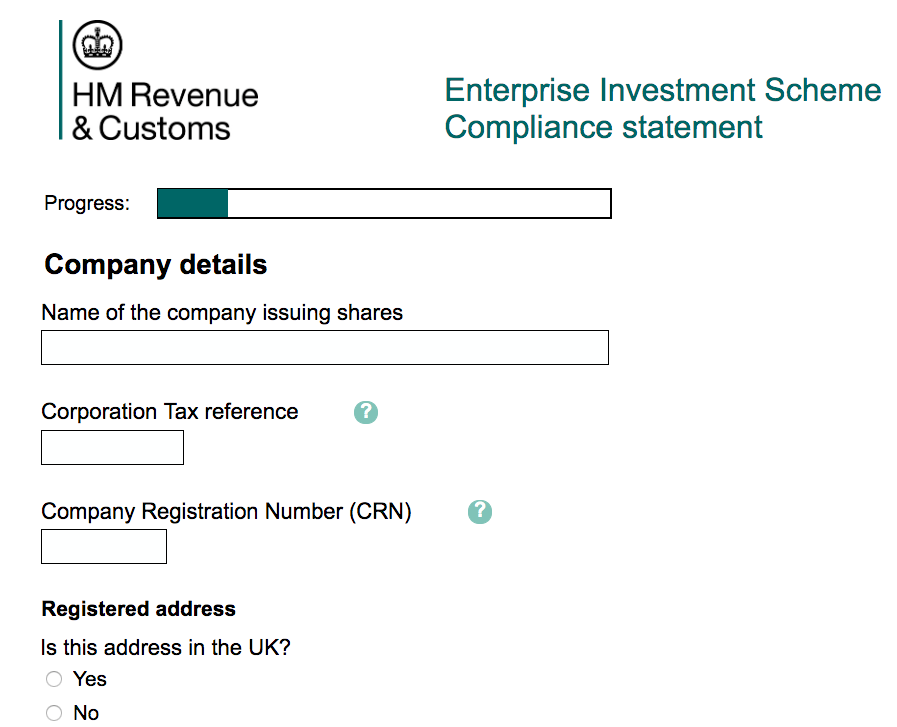

How to apply for EIS1

Next, when you actually issue shares to investors, you will have to submit an EIS1 form (also known as a Compliance Statement) to HMRC. This is essentially an official request for HMRC to approve the shares you issued as EIS eligible. You’ll have to complete a new application for each share issuance you make.

If you’ve previously submitted an Advance Assurance, HMRC already has most of the information it needs from you, so you’ll only have to state that you’ve provided them with an Advance Assurance and, if applicable, send them copies of any potential documents that have changed since you did so. If you haven’t filed an Advance Assurance, you’ll have to provide more details about your company. Here’s the type of information you should be prepared to submit:

-

A business plan (including financial forecasts)

-

Your business’s latest accounts

-

The types of trade and business activities you’re involved in, plus estimated expenses for each of those.

-

An overview of how you meet the risk to capital condition (i.e. that you intend to use the money for growth, and that the investment constitutes a capital risk for investors).

-

An updated copy of your memorandum and articles of association.

-

Any documents you used as part of your fundraising proposal to investors.

-

An account of other potential agreements with your investors.

-

A list of any other venture capital schemes you may have received funds from, including amounts and dates.

-

Other documents you might think are relevant and can help your case.

-

If you’re applying as a Knowledge Intensive Company (see below), you’ll also have to provide evidence that you qualify as such.

Keep in mind that you can only apply for an EIS1 if you’ve been involved in your qualifying business trade for at least 4 months. Your application must be submitted no later than 2 years from the date when this 4-month period ends, or 2 years from the end of the tax year in which you issued the shares (whichever is later). You can complete your EIS form online, send it via email, or post to Venture Capital Reliefs Team, WMBC, HM Revenue and Customs, BX9 1BN.

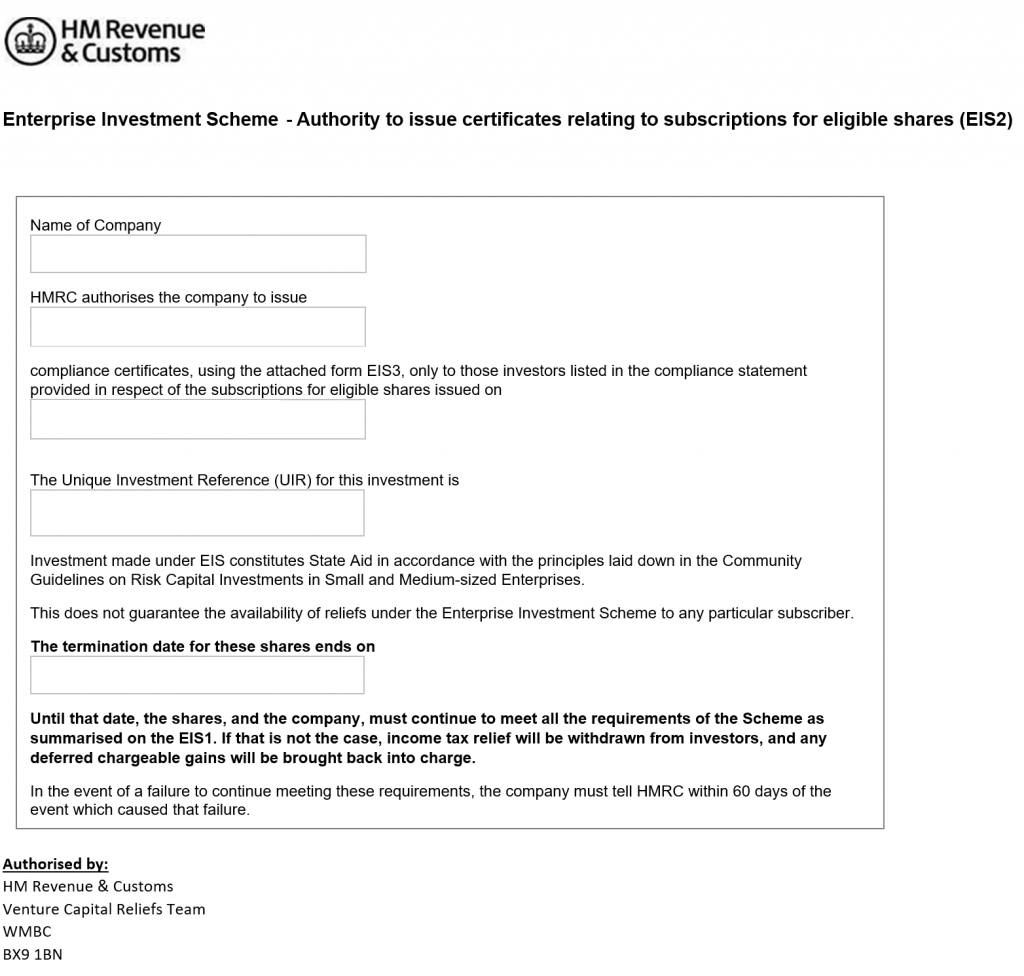

Receiving an EIS2

If the SCEC approves your EIS1 submission, you will receive a document called EIS2. This is an official confirmation from HMRC that you and your investors qualify to receive EIS benefits. The EIS2 document will include a specific reference number, which you will need in order to issue EIS3 certificates to your investors.

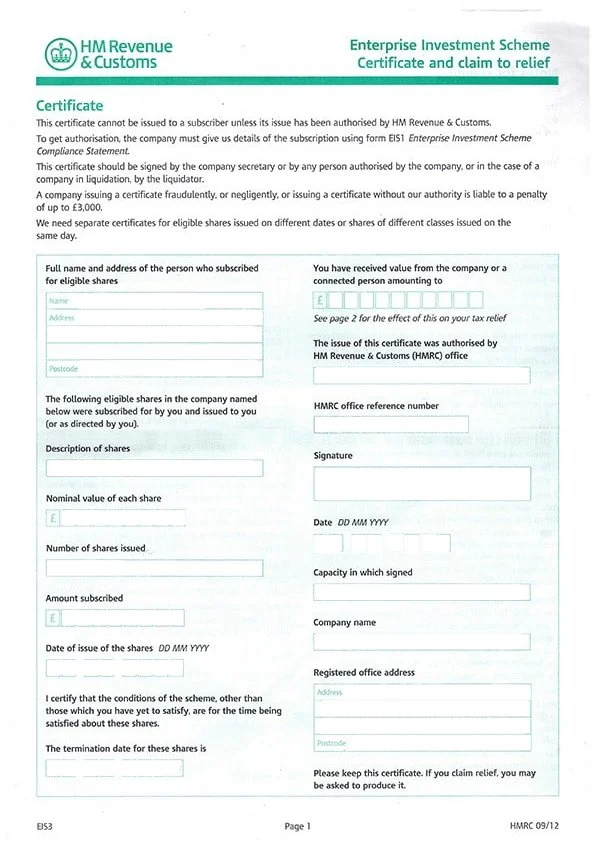

What is an EIS3?

Now that you have formal approval from HMRC, you can proceed to give your investors an EIS3, which is a document they can give to the authorities to claim tax relief. You must issue a separate EIS3 for individual investor. This will contain some basic information about your investor, the investment he/she made, and any other potential tax relief they’re receiving. The form must be signed both by a company representative and the investor themselves before submitted to the authorities.

*For Investors: Please note that it might take several months after you made your investment to receive your tax documentation. This generally depends on how fast the company you invested in is to provide HMRC with information, and how long it takes HMRC to process that.

EIS frequently-asked-questions

What is the difference between EIS and SEIS?

The Seed Enterprise Investment Scheme (SEIS) is very similar to EIS, only designed for even earlier stage companies. The two schemes are virtually the same in terms of the types of trade that are considered acceptable for applying companies, as well what the raised funds can be used for. However, there are important differences between SEIS and EIS, relating to how much money can be raised under each scheme, as well as the characteristics a business must bare in order to qualify for them.

More specifically:

-

Whereas EIS allows each investor to invest up to £1m per tax year and receive a 30% tax relief, with SEIS they can invest up to £100,000 per tax year and receive up to 50% tax break.

In both schemes, the investor will pay no capital gains tax on any profit derived from the sale of the shares after three years. Investors will also pay no inheritance tax on shares they’ve held for a minimum of two years under either scheme. If the shares are ultimately sold at a loss, investors are able to offset that loss against their capital gains tax for both EIS and SEIS shares.

-

While a company can raise up to £12m through EIS, it can only raise a maximum of £150,000 through SEIS. It is possible to raise money under both schemes in the same funding round, but in that scenario it’s essential that any SEIS shares be issued before the EIS ones.

-

In terms of whether your company is eligible, the same criteria that apply for EIS apply for SEIS too with the exception of the following:

-

Whereas EIS requires your company to have under £15m in gross assets prior to the investment, for SEIS you may only have £200,000 or less.

-

EIS companies are allowed to have up to 250 employees, but SEIS eligible ones may only have a maximum of 25.

If you’re still unsure whether you can apply for SEIS, take a look at the HMRC’s full SEIS eligibility criteria.

What is a qualifying trade?

In reality, most trades qualify for EIS, so the better question to ask is rather which trades are not qualifying. According to HMRC, this might be the case if over 20% of your company’s trade has to do with:

-

Coal or steel production

-

Farming or market gardening

-

Property development or leasing activities

-

Legal, financial, banking, insurance, or debt services

-

Running a hotel or nursing home

-

Producing energy (eg. electricity, heat), gas, or other fuels

-

Electricity exports

Please note that this list is not exhaustive, and terms may apply. If you wish to find out more, here’s some more information on non-qualifying trades.

What is a Knowledge Intensive Company (KIC)?

A Knowledge Intensive Company (KIC) is a business focusing on research, development and/or innovation. If you qualify as a KIC at the time you’re issuing EIS shares, you may be entitled to several additional benefits.

Most notably:

-

You’re allowed to raise £20m over your business’s lifetime, as opposed to the standard £12m total.

-

Your fundraising timeframe is extended to a total of 10 years, as opposed to the normal 7 years.

So what exactly does it mean to focus on research, development or innovation? According to HMRC, you must meet the following criteria:

-

Out of your total operating costs, at least 10% was spent on research and development for each of the 3 years preceding the investment OR at least 15% was spent for the same purposes in any of those 3 years.Your business activities are geared towards creating intellectual property, which you expect to be the main source of business for your company within 10 years OR at least 20% of your staff are working in research and development, and hold a relevant Master’s degree or higher.

Please be aware that HMRC may update the qualifying criteria for KICs, so make sure to double check for potential changes before applying.