One platform, unlimited potential

Manage all your equity on a single online platform - from seed to exit

Featured products

Digital Cap Table

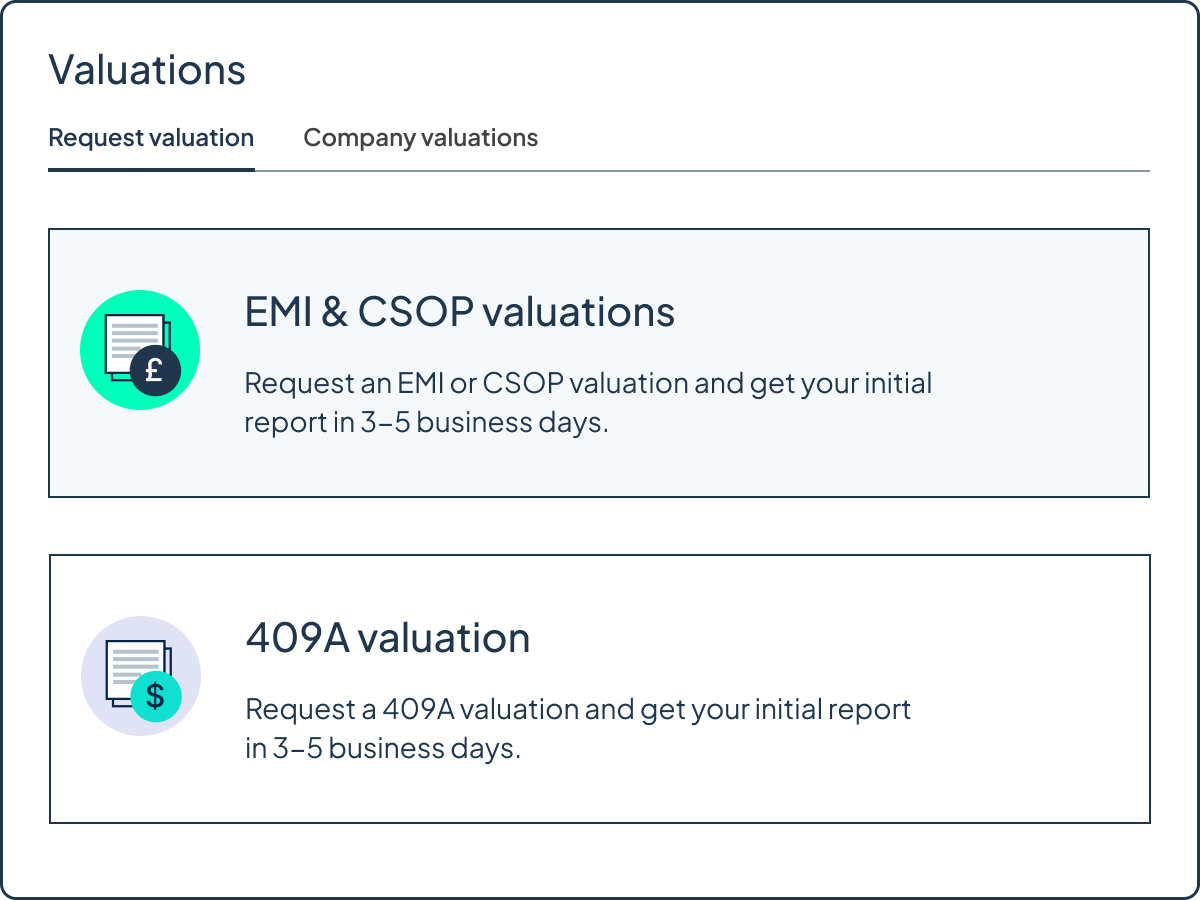

Company Valuations

Why Carta?

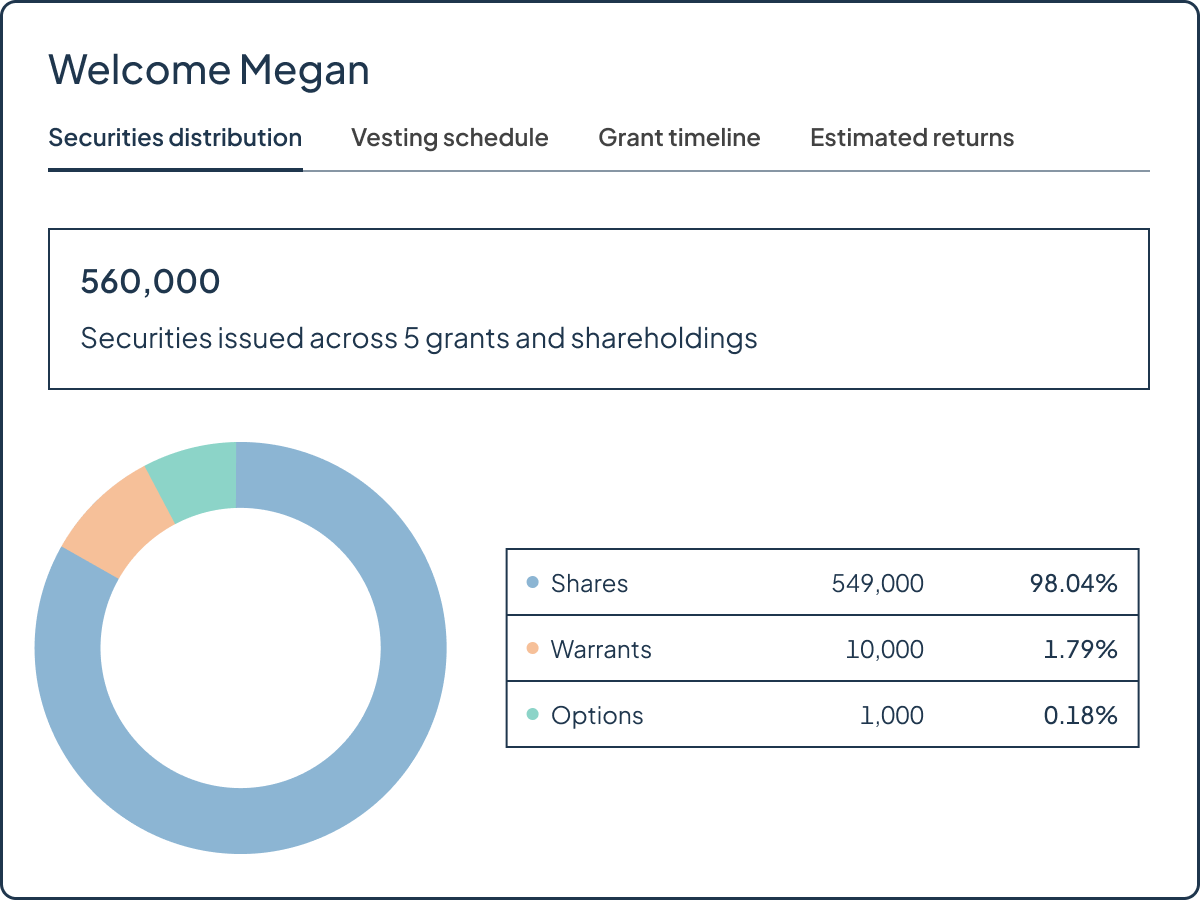

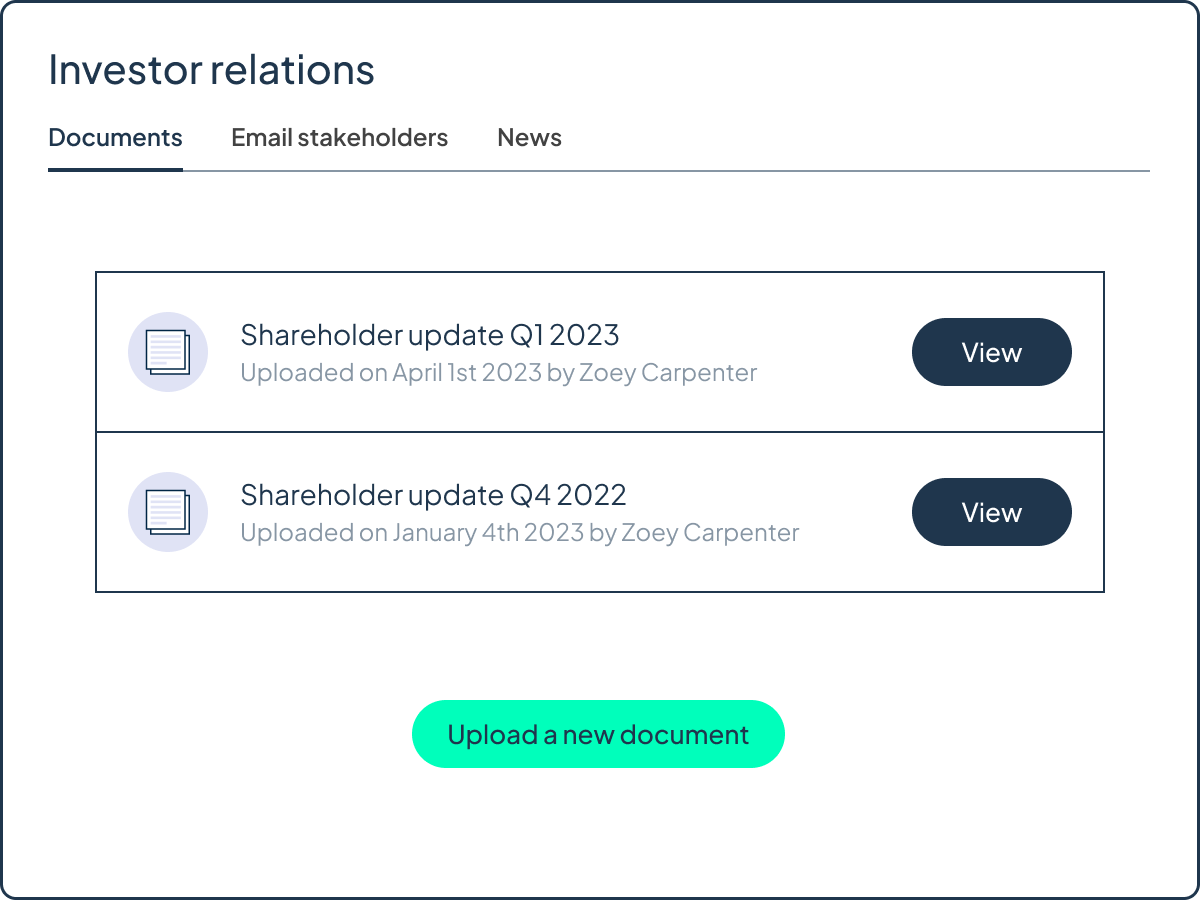

Engage your stakeholders with equity dashboards that chart vesting progress for employees and show investors their estimated return.

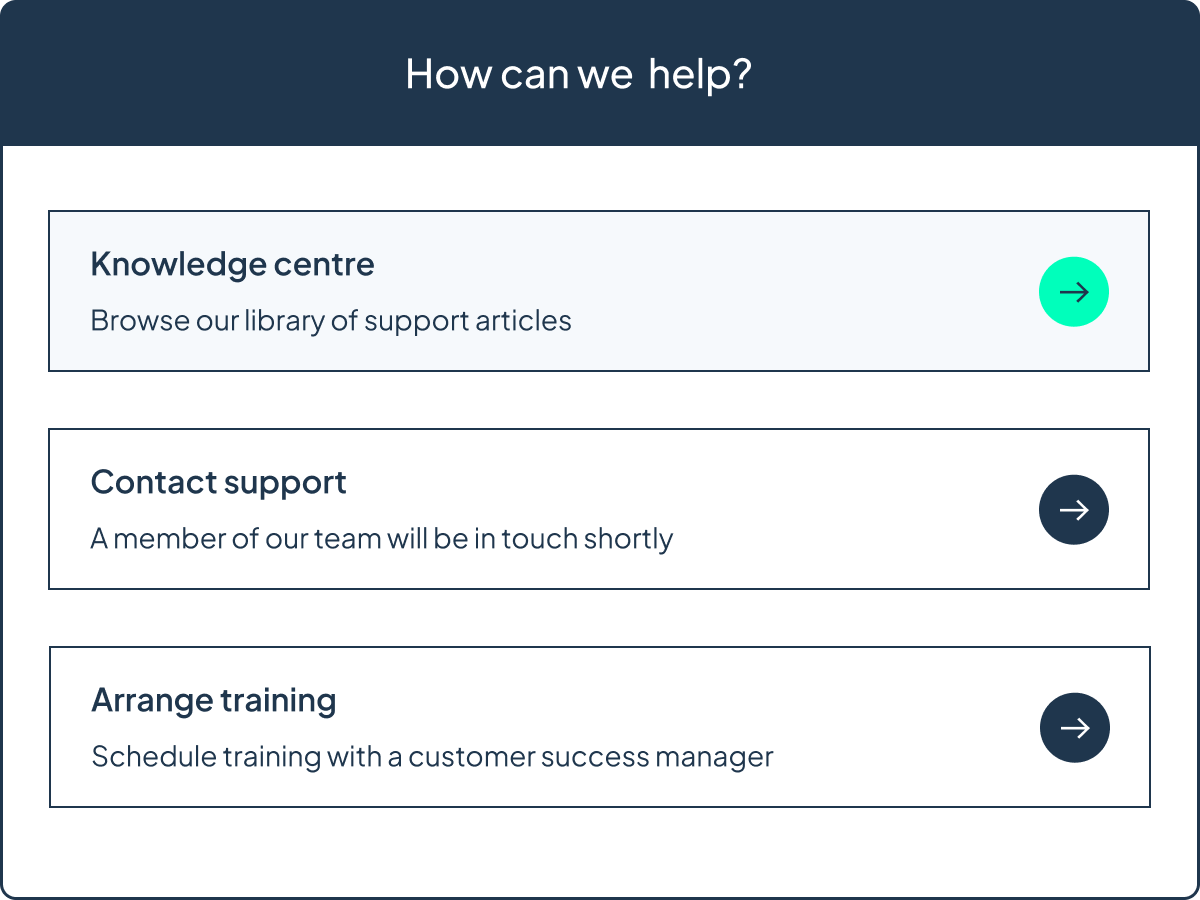

We provide hands-on support migrating your information to Carta and train your team to use the platform with confidence.

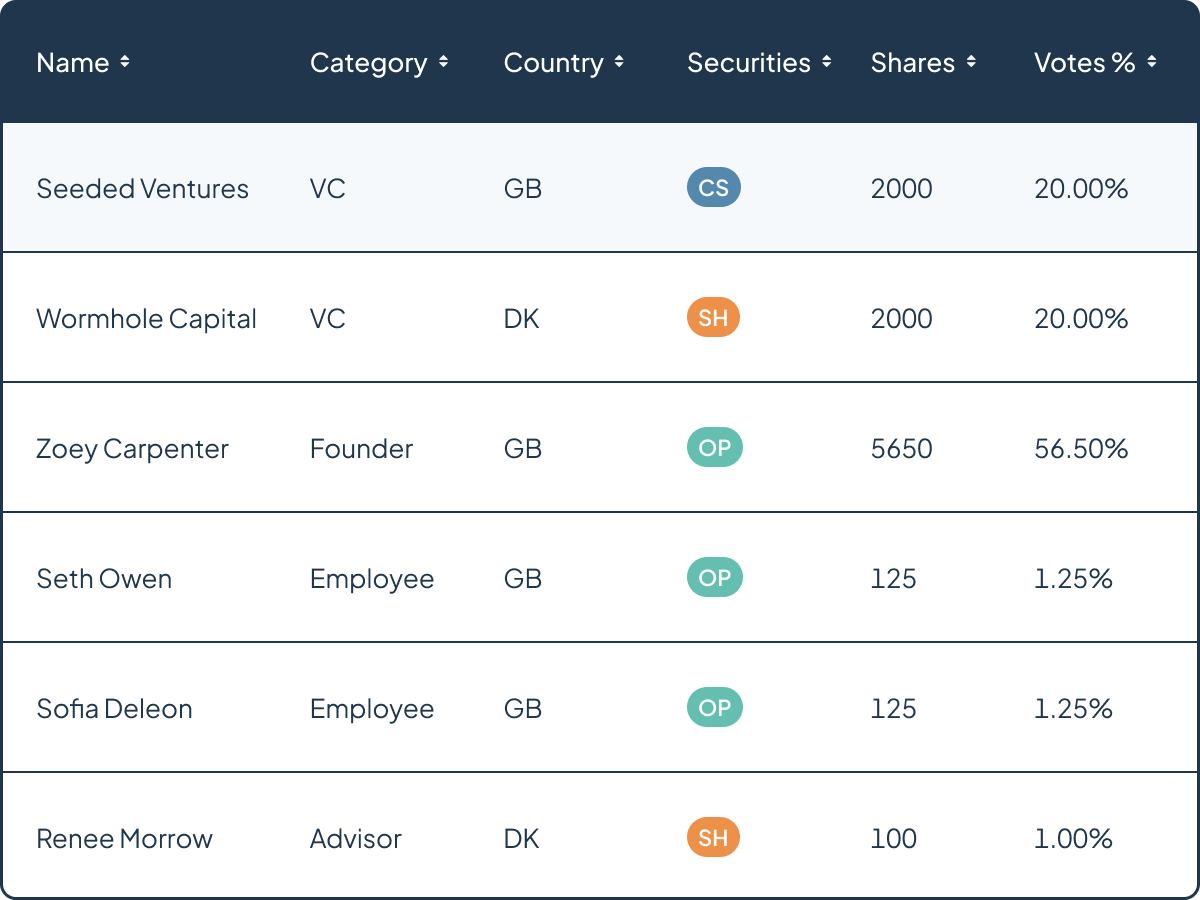

Keep investors informed on their equity position as your cap table evolves with centralised stakeholder management.

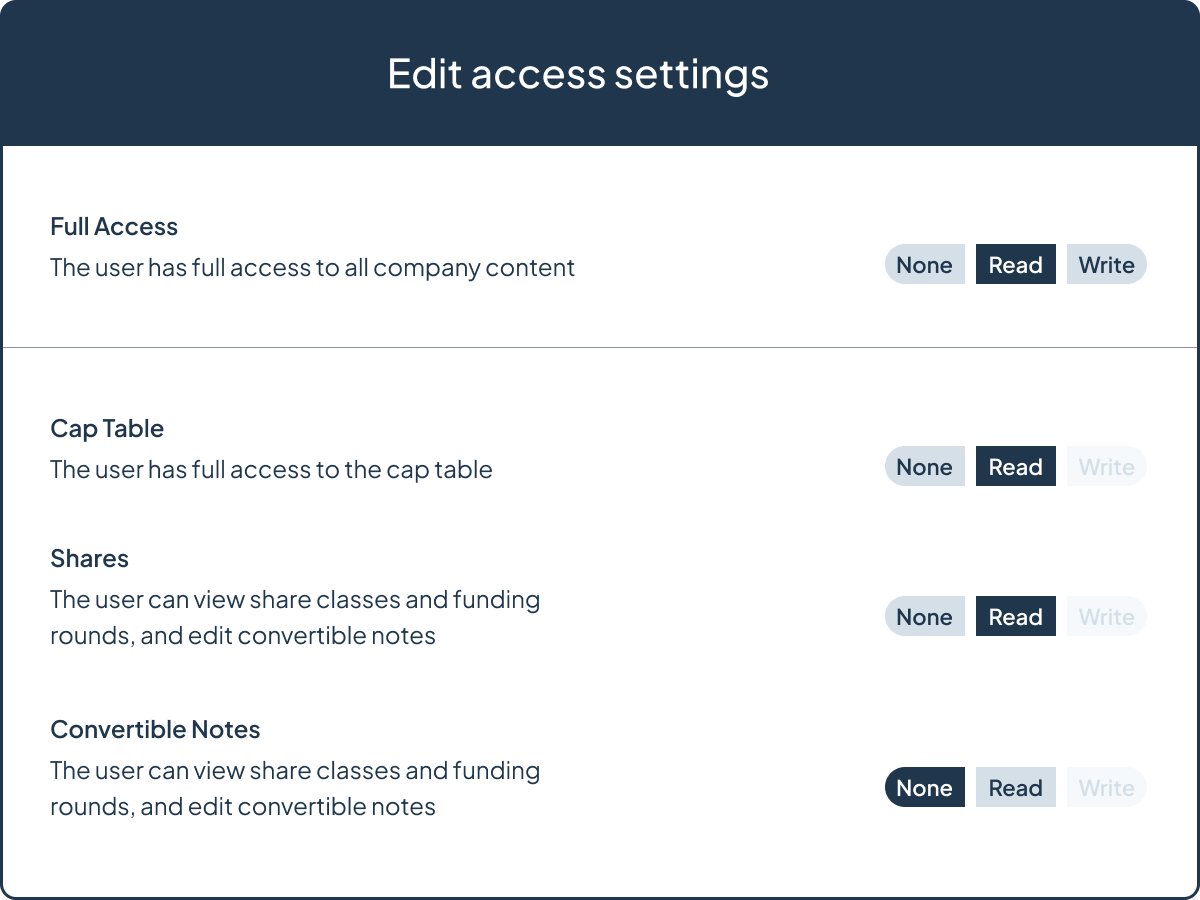

We designed Carta with data protection at its core. Our internal policies, privacy features and testing protocols help keep your data safe.

Supporting owners across the globe

UK

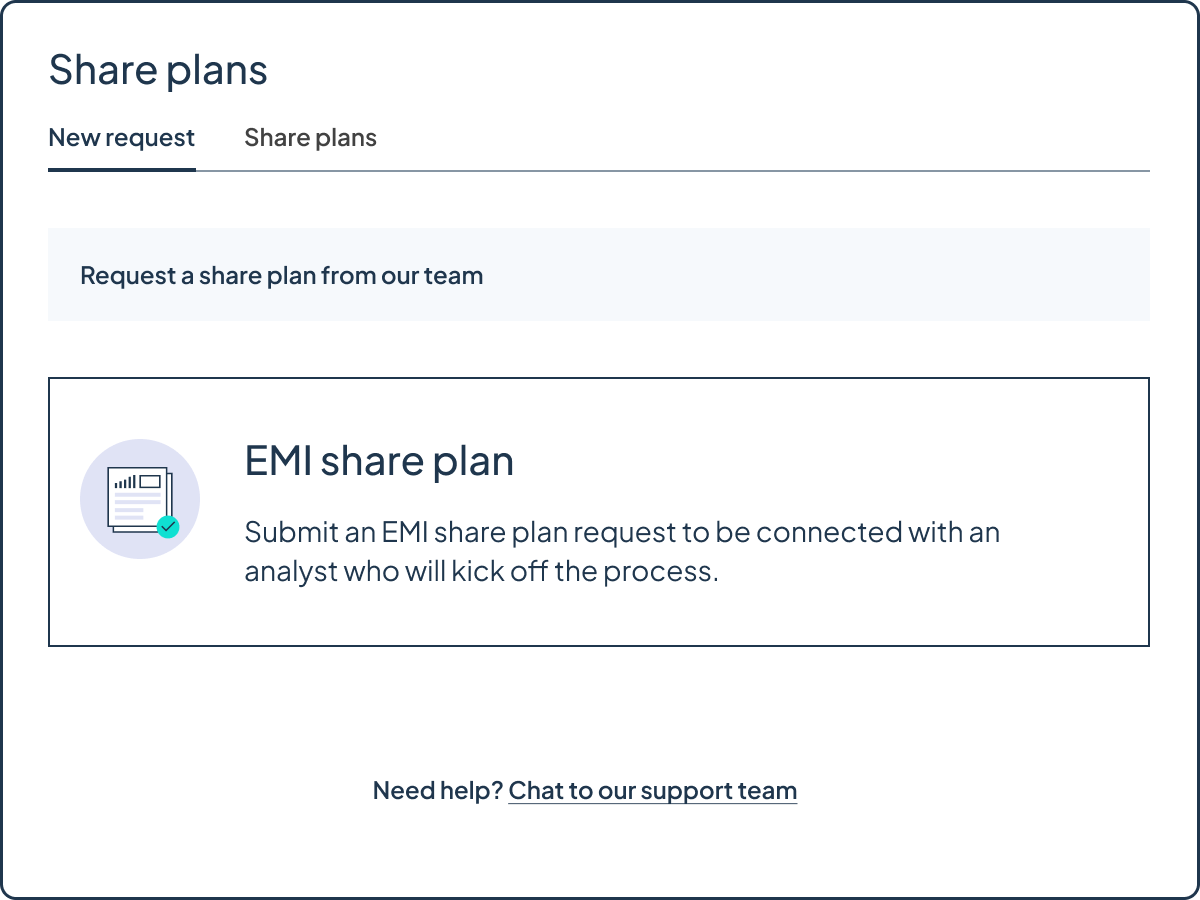

Automated filings for HMRC & Companies House. Support for EMI, CSOP, EIS and deed signing.

Germany

Secure VSOP and share number handling, and on-platform electronic signature process.

France

Support for BSPCE including a fully customisable vesting schedule engine.

Sweden

Support for QESO, plus share registers with automatic share number handling.

Denmark

Support for Danish warrants and share plans across multiple jurisdictions.

EU

Tailored to country-specific needs across jurisdictions, currencies and timezones.